In today’s digital age, the security of online payments is more critical than ever. As cyber threats continue to evolve, businesses and consumers alike are seeking innovative solutions to protect their financial transactions. Blockchain technology has emerged as a game-changer in this arena, offering enhanced security features that safeguard sensitive information and reduce the risk of fraud. By leveraging decentralized ledgers and cryptographic techniques, blockchain not only ensures the integrity of transactions but also fosters trust between parties involved.

This article delves into the various ways blockchain technology enhances online payment security. You will learn about the fundamental principles of blockchain, including its decentralized nature and how it eliminates the need for intermediaries. We will explore real-world applications of blockchain in payment systems, highlighting successful case studies that demonstrate its effectiveness in preventing fraud and ensuring secure transactions. Additionally, we will discuss the potential challenges and limitations of implementing blockchain solutions in the financial sector.

As you continue reading, you will gain valuable insights into the future of online payments and how blockchain technology is poised to revolutionize the industry. Whether you are a business owner looking to enhance your payment security or a consumer interested in understanding the technology behind secure transactions, this article will provide you with the knowledge you need. Join us on this journey to discover how blockchain is reshaping the landscape of online payment security.

Understanding Blockchain Technology

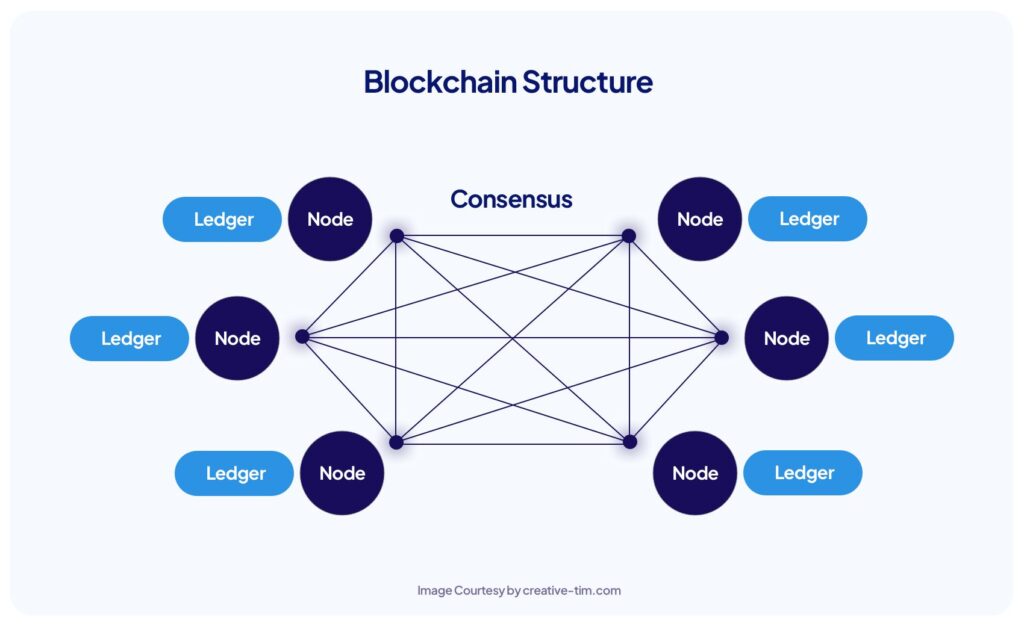

Blockchain technology is a decentralized digital ledger that records transactions across multiple computers. This ensures that the recorded transactions cannot be altered retroactively without the alteration of all subsequent blocks and the consensus of the network. The decentralized nature of blockchain enhances security by eliminating the need for a central authority, which is often a target for cyberattacks. By distributing the data across a network, blockchain minimizes the risk of data breaches and fraud.

Moreover, each transaction on the blockchain is encrypted and linked to the previous transaction, creating a secure chain of information. This cryptographic security makes it extremely difficult for hackers to manipulate transaction data, thereby enhancing the overall security of online payments. As more businesses adopt blockchain technology, understanding its fundamentals becomes crucial for both consumers and merchants alike.

Enhanced Security Features of Blockchain

One of the most significant advantages of blockchain technology is its enhanced security features. Each transaction is verified by a network of computers, known as nodes, before it is added to the blockchain. This consensus mechanism ensures that only legitimate transactions are recorded, reducing the risk of fraud. Additionally, the use of cryptographic algorithms protects sensitive information, making it nearly impossible for unauthorized parties to access or alter transaction data.

Furthermore, blockchain’s immutability feature means that once a transaction is recorded, it cannot be changed or deleted. This creates a permanent and transparent record of all transactions, which can be audited at any time. As a result, businesses can build trust with their customers, knowing that their payment information is secure and that they are protected from potential fraud.

Reducing Chargebacks and Fraud

Chargebacks are a significant concern for online merchants, often leading to financial losses and increased operational costs. Blockchain technology can help reduce chargebacks by providing a transparent and immutable record of transactions. When a customer makes a purchase, the transaction is recorded on the blockchain, creating a verifiable trail that can be referenced in case of disputes.

Additionally, the use of smart contracts—self-executing contracts with the terms of the agreement directly written into code—can automate the payment process and ensure that funds are only released when specific conditions are met. This reduces the likelihood of fraudulent claims and chargebacks, ultimately benefiting both merchants and consumers.

The Role of Cryptocurrencies in Online Payments

Cryptocurrencies, such as Bitcoin and Ethereum, are built on blockchain technology and offer a new way to conduct online transactions. These digital currencies provide an additional layer of security, as they allow for peer-to-peer transactions without the need for intermediaries like banks. This not only speeds up the payment process but also reduces transaction fees, making it an attractive option for both consumers and merchants.

Moreover, cryptocurrencies are often more secure than traditional payment methods, as they utilize advanced cryptographic techniques to protect user information. As the adoption of cryptocurrencies continues to grow, understanding their role in enhancing online payment security becomes increasingly important for businesses looking to stay competitive in the digital marketplace.

Regulatory Challenges and Compliance

While blockchain technology offers numerous benefits for online payment security, it also presents regulatory challenges. Governments around the world are still grappling with how to regulate cryptocurrencies and blockchain-based transactions. Compliance with anti-money laundering (AML) and know your customer (KYC) regulations is essential for businesses operating in this space.

As regulations evolve, businesses must stay informed and adapt their practices to ensure compliance. This may involve implementing robust identity verification processes and maintaining transparent records of transactions. By proactively addressing regulatory challenges, businesses can enhance their credibility and build trust with customers, ultimately leading to increased adoption of blockchain technology in online payments.

Future Trends in Blockchain and Online Payments

The future of blockchain technology in online payments looks promising, with several trends emerging that could further enhance security. One such trend is the integration of artificial intelligence (AI) with blockchain, which can help identify fraudulent activities in real-time. By analyzing transaction patterns and behaviors, AI can flag suspicious activities and prevent potential fraud before it occurs.

Additionally, the rise of decentralized finance (DeFi) platforms is changing the landscape of online payments. These platforms leverage blockchain technology to offer financial services without traditional intermediaries, providing users with greater control over their assets. As these trends continue to develop, businesses and consumers alike will benefit from the enhanced security and efficiency that blockchain technology brings to online payments.

| Aspect | Description |

|---|---|

| Introduction | Blockchain technology is a decentralized digital ledger that records transactions across multiple computers securely and transparently. |

| Security Features | Blockchain enhances security through cryptographic techniques, making it difficult for unauthorized parties to alter transaction data. |

| Decentralization | By eliminating a central authority, blockchain reduces the risk of single points of failure and fraud in online payments. |

| Transparency | All transactions are recorded on a public ledger, allowing users to verify transactions independently, which builds trust. |

| Immutability | Once a transaction is recorded on the blockchain, it cannot be changed or deleted, ensuring the integrity of payment records. |

| Smart Contracts | Smart contracts automate payment processes and enforce terms without intermediaries, reducing the risk of disputes. |

| Cost Efficiency | Blockchain can lower transaction fees by reducing the need for intermediaries, making online payments more affordable. |

| Challenges | Despite its advantages, blockchain faces challenges such as scalability, regulatory issues, and the need for user education. |

| Conclusion | Blockchain technology significantly enhances online payment security, offering a reliable alternative to traditional payment systems. |