In recent months, the world has witnessed an unprecedented surge in inflation rates, with many countries reporting figures that have reached record highs. This phenomenon, often referred to as “global inflation,” has sparked widespread concern among economists, policymakers, and consumers alike. As prices for essential goods and services continue to rise, understanding the underlying factors driving this inflation becomes crucial for navigating the current economic landscape.

In this article, we will delve into the key drivers behind the soaring inflation rates, including supply chain disruptions, increased demand post-pandemic, and monetary policy responses from central banks. We will also explore how these factors are interconnected and their implications for both developed and developing economies. Furthermore, we will examine the impact of inflation on everyday consumers, from rising grocery bills to increased housing costs, and what this means for financial planning in the near future.

As we unpack the complexities of global inflation, we will provide insights into potential strategies that individuals and businesses can adopt to mitigate the effects of rising prices. Whether you are a consumer trying to make sense of your budget or a business owner looking to adapt to changing market conditions, this article aims to equip you with the knowledge you need to navigate these challenging times. Stay with us as we explore the multifaceted world of inflation and its far-reaching consequences.

Factors Contributing to Rising Inflation

Inflation rates have surged globally due to a combination of factors, including supply chain disruptions, increased demand post-pandemic, and rising energy prices. The COVID-19 pandemic has led to significant changes in consumer behavior, with many people returning to the market and driving demand for goods and services. This sudden spike in demand, coupled with ongoing supply chain issues, has created a perfect storm for inflationary pressures.

Additionally, geopolitical tensions and conflicts have further exacerbated the situation, particularly in energy markets. As countries grapple with these challenges, the cost of raw materials and transportation has increased, contributing to higher prices for consumers. Understanding these factors is crucial for policymakers and economists as they navigate the complexities of the current economic landscape.

Impact of Inflation on Consumer Behavior

As inflation rates rise, consumer behavior tends to shift significantly. Higher prices can lead to decreased purchasing power, prompting consumers to prioritize essential goods over luxury items. This change in spending habits can have a ripple effect on various sectors of the economy, particularly retail and hospitality, which may see a decline in sales as consumers tighten their budgets.

Moreover, inflation can lead to increased savings rates as individuals become more cautious about their spending. This shift can slow down economic growth, as businesses may experience reduced revenue and, consequently, may be forced to cut costs or delay investments. Understanding these behavioral changes is essential for businesses looking to adapt to the evolving economic environment.

Central Banks’ Response to Inflation

In response to rising inflation, central banks around the world are reevaluating their monetary policies. Many are considering tightening monetary policy by raising interest rates to curb inflationary pressures. This approach aims to reduce consumer spending and borrowing, ultimately stabilizing prices. However, such measures can also have unintended consequences, including slowing economic growth and increasing unemployment rates.

Central banks must strike a delicate balance between controlling inflation and supporting economic recovery. The decisions made in this regard will have long-term implications for financial markets, investment strategies, and overall economic stability. As central banks navigate these challenges, their actions will be closely monitored by investors and policymakers alike.

Inflation and Its Effect on Investment Strategies

Investors are increasingly concerned about the impact of rising inflation on their portfolios. Inflation erodes the purchasing power of money, making it essential for investors to seek assets that can provide a hedge against inflation. Real estate, commodities, and inflation-protected securities are often considered attractive options during inflationary periods.

Moreover, equities can also serve as a potential hedge, as companies with strong pricing power may be able to pass on increased costs to consumers. However, investors must remain vigilant and adapt their strategies to the changing economic landscape. Diversification and a focus on sectors that historically perform well during inflationary periods can help mitigate risks associated with rising prices.

Global Inflation Trends: A Comparative Analysis

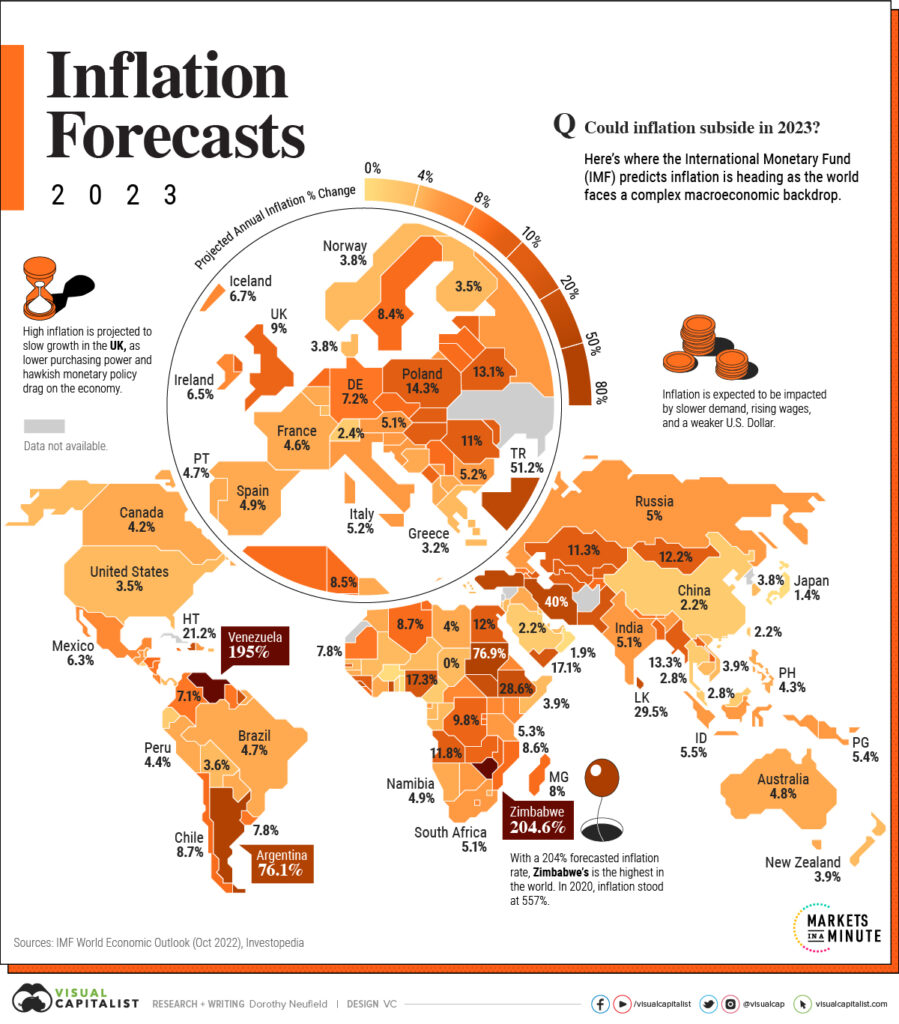

Examining global inflation trends reveals significant disparities between different regions. While some countries experience hyperinflation, others maintain relatively stable prices. For instance, emerging markets may face higher inflation rates due to currency fluctuations and supply chain vulnerabilities, while developed economies may benefit from stronger monetary policies and economic resilience.

Understanding these trends is crucial for businesses and investors looking to navigate the global market. A comparative analysis of inflation rates across various countries can provide valuable insights into potential opportunities and risks. Below is a table summarizing the inflation rates of selected countries:

| Country | Inflation Rate (%) |

|---|---|

| United States | 8.5 |

| Germany | 7.0 |

| Brazil | 9.5 |

| India | 6.3 |

Future Outlook: Will Inflation Continue to Rise?

The future outlook for inflation remains uncertain, with various factors influencing potential trends. Economists are divided on whether current inflationary pressures are transitory or indicative of a longer-term trend. Supply chain recovery, labor market dynamics, and global economic conditions will play critical roles in shaping the

Inflation has become a pressing issue worldwide, affecting economies, consumers, and businesses alike. This summary provides an overview of the current state of global inflation rates, their causes, and implications.

| Region | Current Inflation Rate (%) | Key Factors | Implications |

|---|---|---|---|

| North America | 8.5 | Supply chain disruptions, increased consumer demand, energy prices | Higher cost of living, potential interest rate hikes |

| Europe | 7.0 | Energy crisis, post-pandemic recovery, geopolitical tensions | Economic slowdown, increased government spending |

| Asia | 5.5 | Commodity price increases, currency fluctuations | Impact on exports, adjustments in monetary policy |

| Latin America | 9.0 | Political instability, inflationary pressures from imports | Social unrest, changes in fiscal policy |

| Africa | 6.8 | Food supply issues, currency depreciation | Increased poverty rates, challenges in economic growth |

Conclusion

The record-high inflation rates across various regions highlight the interconnectedness of global economies and the challenges they face. Policymakers must navigate these turbulent waters to stabilize their economies and protect consumers.